Can I Upload Freshbooks Invoices Into Wave

Cloudwards.net may earn a small committee from some purchases made through our site. Yet, any chapter earnings exercise non affect how we review services.

FreshBooks and Moving ridge are among the best bookkeeping software, so modest businesses should consider the user-friendly, cloud-based programs when they're shopping around. That said, both will fulfill the core bookkeeping needs of any business — invoicing and bill payment — then information technology'due south necessary to look deeper to identify their differences and cull between them.

For an in-depth look at each, we advise you read our FreshBooks review and our Wave review.

1. Invoicing

Collecting on monies owed is cardinal to any business organisation'due south survival. Many small businesses first turn to a deject-based accounting solution because they know they demand to better staying on meridian of and tracking accounts receivable. Information technology's the one role yous're guaranteed to observe in every accounting software plan. The nautical chart below compares FreshBooks'southward and Wave'south invoicing options.

| Services: | FreshBooks | Wave |

|---|---|---|

| Send recurring invoices | ||

| Automatically add belatedly fees | ||

| Ship payment reminders | ||

| Integrate with inventory | ||

| Bill for hours worked | ||

| Customize invoices | (non many options) | (non many options) |

FreshBooks gives users a comprehensive invoicing system. Its invoices are clearly laid out, with common fields such equally client, quantity and notes. After setting upward an invoice, you can select how ofttimes you want to ship payment reminders for past due invoices. FreshBooks is unique in the marketplace in that it lets yous customize payment reminders and late fees by client.

Many businesses bill for the same services each month. FreshBooks "make recurring" feature appears after every invoice y'all enter and save or you lot can select it when inputting an invoice. The time-saving role also ensures that your clients go billed, fifty-fifty if your bookkeeper calls in sick or forgets.

Wave has the ability to ready upwardly recurring bills, also, and gives you lot more payment reminder options. In that location is no mode to add late fees to an invoice automatically like you can in FreshBooks, though. In Moving ridge, you have to add a new line particular to an existing invoice if y'all want to charge a late fee.

In FreshBooks, hours worked on a client'southward project get pulled in to invoices. The service includes a projects role, which Wave doesn't have. Creative and project-based businesses should accept a deeper look at FreshBooks when determining their accounting software needs.

FreshBooks has a bones inventory system, unless you lot purchase an app, but y'all can select from items on hand when creating an invoice. Wave doesn't include inventory options, only if you need to track quantities on paw and manage meaning inventory, we suggest yous bank check out Xero. If yous're curious, y'all can read our review of FreshBooks vs Xero.

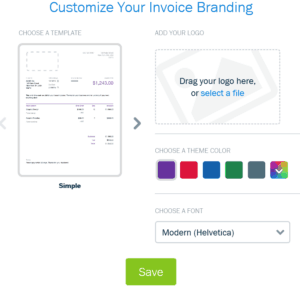

Though customization options for invoices exist in FreshBooks and Wave, they're limited. Options you can customize include colors, fonts and layout. Moving ridge has three invoice templates y'all tin can add a logo to, while FreshBooks provides more templates and includes estimates and proposals.

Sending an invoice is only the first footstep. While both will transport automatic payment reminders to customers who are overdue, information technology'southward nonetheless a proficient idea for business owners to keep an middle on cash period.

Outstanding revenue appears at the very pinnacle of FreshBooks' main dashboard. Information technology displays the total amount due in blood-red as a visual reminder of unpaid invoices. In its "advanced reports" section, yous'll detect an accounts aging study, which breaks out past due receivables by the length of time you've been owed.

Wave's dashboard also presents invoices that y'all're owed, just you have to curlicue down to observe the information. That said, its "invoices" screen displays overdue invoices front and heart. An accounts aging report is too included in its "reports" department.

For invoicing, FreshBooks is superior to Wave. It includes more than options, such as preparing estimates and proposals that convert to invoices, and more than automated functions.

2. Bills

Paying bills is a necessary, if unpleasant, role of doing business. FreshBooks and Wave brand it as painless as possible. Buttons on the main folio take you straight to the form to enter a new expense.

In FreshBooks, the expense form lets you select the type of expense from a drop-down carte. You can upload and attach a receipt, if needed, and mark it every bit billable if a client owes reimbursement. The service gives you the choice to store a credit card on file and utilize it to pay bills, too.

The "make recurring" option appears on every new expense form. If you pay the same expenses monthly, such equally hire or a utility payment, machine-payments salve fourth dimension and ensure that you never incur a late fee because you missed an important bill. After selecting how ofttimes it should be paid and how many times, you lot tin forget about information technology.

Though it's easy to find and complete an expense course in Wave, y'all'll have to accept the additional pace of clicking "create nib" if you go through "purchases" and "bills" in the main navigation bill of fare.

Moving ridge doesn't let users fix recurring pecker payments and doesn't keep a credit bill of fare on file.

On Moving ridge'due south expense form, you can assign numbers, blazon notes and attach receipts, but you can't add a line for taxes.

Expenses that have been booked appear as a pie chart grade on FreshBooks's principal dashboard. Wave shows overdue bills and invoices in a list to the left of its dashboard. Both have expense reports, so keeping track of coin flowing out of your business isn't difficult with them.

FreshBooks's bill-paying features give you more options and functionality than Wave's, with recurring payments and stored credit cards. It's the articulate winner in this category.

3. Reports

FreshBooks's reports will never win when compared to those of other cloud-based accounting programs. Information technology's an odd expanse for the service to neglect, given its importance for making business concern decisions, only it only has 9 reports.

The sole financial statement included in FreshBooks is the profit and loss. There is no balance canvass or cashflow statement. Banks and lenders typically request all three when you're applying for a loan, so FreshBooks users would have to prepare the other 2 manually.

Moving ridge provides users with the 3 major fiscal statements, also as a much larger selection of reports related to other areas of your business.

Accounts aging reports calculate the amount of past due receivables by typical timeframes such as 0-xxx days past due or 90-plus days past due, but Wave likewise has a written report that displays income by customer. FreshBooks stops at the accounts aging report.

Wave's additional reports cover sales tax, wages and payroll if you're paying for its payroll functions. While information technology tracks sales and payroll taxes, you can't file them online.

Neither service lets you customize your reports beyond selecting date ranges. That won't be an upshot for more straightforward businesses, but circuitous companies may want to change account groupings and displays. QuickBooks Online has the best report customization options.

Wave beats FreshBooks in this category, but neither will serve the needs of complex businesses or owners who expect to reports to analyze and grow their businesses. If you need more, we suggest looking at QuickBooks Online. Our QuickBooks Online review outlines its pros and cons.

4. Pricing

No competitor is going to beat Wave'due south pricing because information technology is free. It gives yous all the features that nosotros've discussed without charging a monthly fee. It does charge for payroll and merchant processing, though, and the company claims that enough from those to permit information technology to give users everything else.

FreshBooks follows the three-tiered monthly pricing plan that so many of its rivals use. The everyman monthly program, Lite, lets five users access the program for $xv per month. The service's bones functions are included, but it's not until you pay $25 per month for the middle tier, Plus, that you lot tin send payment reminders, accuse late fees and schedule recurring expenses.

The summit tier, Premium, costs $l per month. It doesn't add features, but allows upwardly to 500 users to work with your account. While information technology's unlikely that a business would accept that many bookkeepers, it would exist useful if yous used the projects role heavily.

Wave charges fees for tax services, payroll and credit bill of fare processing. Payroll and taxation services are only available in six states and cost $25 per calendar month plus $4 per employee. For just payroll, information technology charges $20 per month plus $4 per employee.

FreshBooks doesn't have an integrated payroll service. Instead, you'll have to pay for an add-on, such equally Gusto. If you're looking for a plan which does integrate payroll processing, we propose reading our Xero review.

For a small business that needs to keeps costs under control, information technology'south worth it to sign up for Moving ridge'south free service, fifty-fifty if you might have to deal with its drawbacks. That's why it wins in this category.

5. User-Friendliness

Information technology's easy to detect your way around FreshBooks and Wave. Card items are clearly labeled and make sense. Buttons to "add together new" items, such as invoices or bills, are prominently displayed. Steps to consummate tasks are intuitive and don't crave much software experience.

FreshBooks does a lot to support its users. Links to relevant aid articles, along with hints and tips, announced on primary screens when you navigate to them for the showtime time. Customer back up tin be reached by email or phone.

Wave's help section includes concern guides, weblog posts and videos. The "assistance" push e'er appears to the left on the menu. When yous click on it, a box pops upwards that allows y'all to search the library without leaving the screen that y'all're on.

Nosotros didn't find much to differentiate between the companies in user-friendliness, so we're calling this section a necktie.

Circular: User-Friendliness

No clear winner, points for both

6. Advanced Functions

Though FreshBooks doesn't offer complex inventory or fixed avails functions, it does include projects. Artistic businesses that work on projects for their clients, or those that bill hourly, will find a lot to like in the feature.

When setting upward a new projection in FreshBooks, it'south easy to assign tasks and due dates to team members. Multiple people can exist invited to contribute to the project, including external clients, just you can control their access.

Hourly billing on projects feeds in to invoices. If you're sending an invoice to a customer for another particular and they owe for hours outstanding, FreshBooks reminds you lot. If your employees pecker at different hourly rates — a senior projection manager versus a junior manager, for case — FreshBooks pulls that in to the project billing, also.

Competitor Xero gives users inventory, stock-still assets and projects capabilities. If you lot need all iii, we suggest checking out our FreshBooks vs. Xero comparison.

The merely way to manage projects, fixed assets or inventory in Wave is if you lot sign upwards and pay for an additional program that integrates with information technology.

7. The Verdict

The similarities between FreshBooks and Wave make it difficult to choose betwixt them, only FreshBooks has a slight edge. Information technology gives users more options in invoicing and billing, provides a projects function for service and creative businesses and is reasonably priced compared to other competitors.

That said, Wave's reports give business concern owners more tracking and decision-making tools and its price tin can't exist beat. If y'all're willing to manually enter recurring bills every month and want to cut costs, information technology'southward worth a look.

As always, cheers for reading. If you've tried either program, what did you think? Did you lot have a preference? Let us know in the comments beneath.

Source: https://www.cloudwards.net/freshbooks-vs-wave/

0 Response to "Can I Upload Freshbooks Invoices Into Wave"

Post a Comment